Crypto scalping is a high-frequency trading strategy that allows traders to make quick profits from small price movements in the volatile cryptocurrency market. With the increasing adoption of digital assets, finding the best crypto scalping strategy in 2025 is crucial for maximizing gains while minimizing risks.

In this article, TopCoin9 will explore the fundamentals of crypto scalping strategy, the top techniques, and essential tools to help you succeed in the fast-paced world of scalping.

What is Crypto Scalping?

Crypto scalping is a short-term trading strategy where traders aim to profit from small price fluctuations in cryptocurrency markets. Unlike swing or day trading, scalping involves executing multiple trades within minutes or even seconds, capitalizing on minor price changes. This method relies on technical analysis, real-time market data, and automation tools to maximize efficiency.

To succeed in crypto scalping, traders need to adopt the most effective techniques that align with market trends. Several crypto scalping strategies stand out, offering profitable opportunities for both beginners and experienced traders. Let’s explore the top methods that can help you optimize your trading results.

Key Crypto Scalping Strategies

To maximize profits in crypto scalping, traders must use well-structured strategies that take advantage of small price movements. The most effective crypto scalping strategies involve quick execution, risk management, and leveraging market conditions. Below are some of the most popular approaches in 2025:

- Market-Making Strategy – Placing buy and sell orders simultaneously to profit from the bid-ask spread.

- Arbitrage Scalping – Exploiting price differences across multiple exchanges for instant gains.

- Momentum Scalping – Using indicators like RSI and MACD to trade based on short-term price trends.

- Range Trading – Identifying support and resistance levels to buy low and sell high within a fixed range.

- High-Frequency Trading (HFT) – Leveraging algorithms and trading bots to execute hundreds of trades per second.

Each of these methods has its advantages and risks, but choosing the best crypto scalping strategy depends on market conditions, trading experience, and available tools.

Best Crypto Scalping Strategy

The best crypto scalping strategy in 2025 combines multiple techniques to maximize efficiency and profitability. Successful traders use a mix of crypto scalping strategies, leveraging automation and real-time data to make precise market entries and exits. Key elements of an effective strategy include:

- Combining Market-Making & Momentum Trading – Using market-making to earn from spreads while applying momentum indicators like RSI and MACD for trend confirmation.

- Utilizing AI-Powered Trading Bots – Automating trades to execute orders instantly based on market conditions.

- Implementing Risk Management – Setting stop-loss and take-profit levels to protect capital and minimize losses.

- Choosing the Right Trading Platform – Ensuring low fees, fast execution, and access to leverage for optimal results.

While strategy is crucial, having the right tools is equally important for scalping success. Let’s explore the essential tools for crypto scalping that every trader should use in 2025.

Essential Tools for Crypto Scalping

To succeed in crypto scalp trading, traders need reliable tools to execute trades quickly and efficiently. Since crypto scalping strategies rely on high-speed transactions and precise market analysis, the right tools can significantly impact profitability. Below are the essential tools for scalping in 2025:

- Trading Bots & Automation – AI-powered bots like Pionex, 3Commas, and Bitsgap help execute multiple trades instantly.

- Technical Indicators – RSI, MACD, Bollinger Bands, and VWAP assist in identifying entry and exit points.

- High-Speed Trading Platforms – Exchanges with low latency, low fees, and advanced order types like Binance, Bybit, and Kraken.

- Risk Management Tools – Stop-loss, take-profit orders, and position-sizing calculators to minimize losses.

- News & Sentiment Analysis Tools – Platforms like CryptoPanic and Santiment help traders react to breaking news and market trends.

While these tools enhance trading efficiency, crypto scalping still comes with advantages and risks. In the next section, we will explore the pros and cons of crypto scalping to help you decide whether this strategy suits your trading style.

Pros and Cons of Crypto Scalping

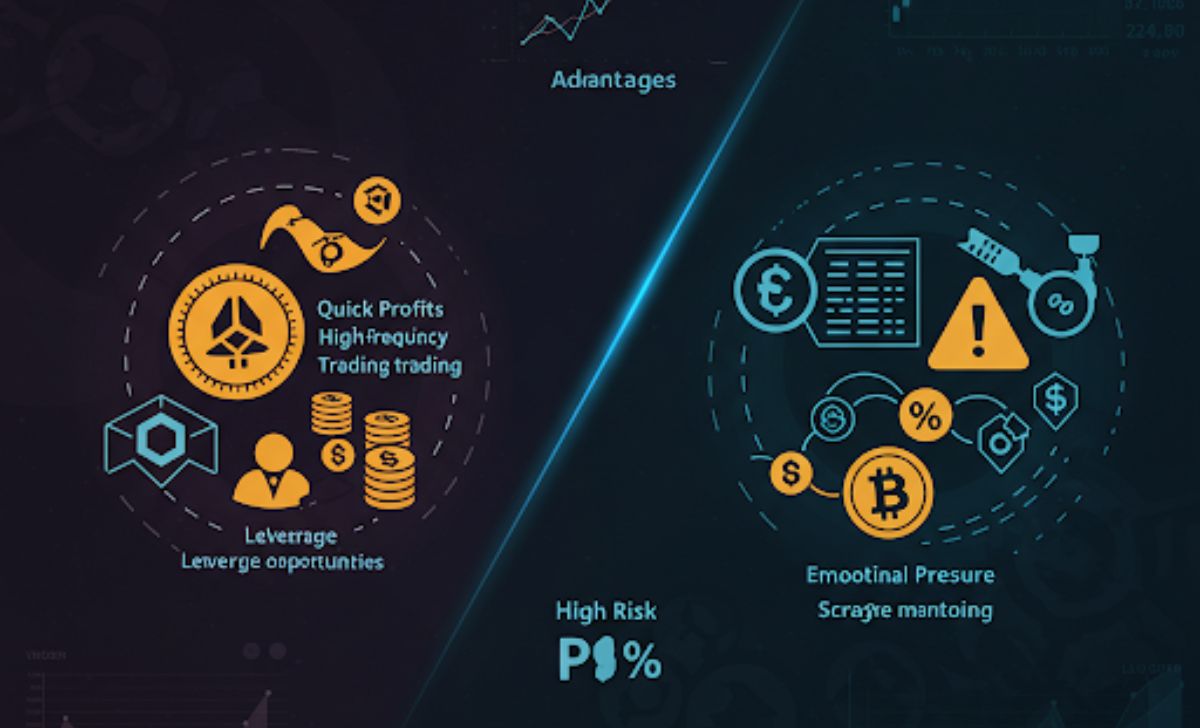

Like any trading strategy, crypto scalping has both advantages and challenges. While it offers opportunities for quick profits, it also requires skill, discipline, and the right tools to execute effectively. Here are the key pros and cons of crypto scalp trading:

Pros of Crypto Scalping:

- Quick Profits – Small price movements occur frequently, allowing traders to accumulate gains throughout the day.

- Lower Market Risk Exposure – Since trades are executed within minutes or seconds, exposure to major market downturns is reduced.

- High Trading Frequency – More opportunities to profit compared to long-term trading strategies.

- Work in Any Market Condition – Scalping can be effective in both bullish and bearish markets.

Cons of Crypto Scalping:

- Requires Significant Time & Attention – Scalpers must stay alert to execute trades instantly.

- High Transaction Costs – Frequent trading leads to higher exchange fees, impacting overall profitability.

- Emotional & Psychological Pressure – Constantly making quick decisions can be stressful for traders.

- Requires Advanced Trading Knowledge – Scalping involves understanding technical indicators, risk management, and execution speed.

Despite these challenges, beginners can still succeed in crypto scalp trading by following best practices and disciplined strategies. Up next, let’s explore tips for successful crypto scalp trading for beginners, helping new traders navigate this high-paced trading approach.

Tips for Successful Crypto Scalp Trading for Beginner

For those new to crypto scalping, mastering the basics and following a disciplined approach can make the difference between success and failure. Here are some essential tips to help beginners navigate crypto scalp trading effectively:

- Choose the Right Exchange: Select a trading platform with low fees, fast execution speeds, and high liquidity to avoid unnecessary costs and slippage. Popular choices include Binance, Bybit, and Kraken.

- Start with a Demo Account: Before using real funds, practice with a demo account to get familiar with crypto scalping strategies and market behavior.

- Use Technical Indicators: Utilize tools like RSI, MACD, Bollinger Bands, and VWAP to identify entry and exit points with precision.

- Automate Your Trades: Consider using trading bots like 3Commas or Pionex to execute trades automatically, reducing emotional decision-making.

- Implement Strict Risk Management: Set stop-loss and take-profit levels for every trade to protect capital and minimize losses. Scalping requires discipline to cut losses quickly.

By following these tips, beginners can gradually develop confidence and efficiency in crypto scalping strategy. With the right mindset, risk management, and tools, even new traders can succeed in this fast-paced trading approach.

Conclusion

Crypto scalping is a fast-paced trading strategy that offers opportunities for quick profits but requires skill, discipline, and the right tools. By choosing an effective crypto scalping strategy, utilizing automation, and implementing strict risk management, traders can maximize their chances of success. While scalping presents challenges like high fees and emotional pressure, beginners can overcome these by following best practices and continuously improving their techniques.

With over a decade of experience in finance and blockchain, David Anderson has been a key figure in the crypto space, contributing to top publications like CoinDesk. As the Founder & Editor-in-Chief of TopCoin9, he is dedicated to providing accurate, insightful, and cutting-edge analysis of the crypto market.

Email: [email protected]