Polkadot Market Cap is a crucial indicator for evaluating the real-time value and long-term potential of the DOT token in 2025. It reflects not only market valuation but also investor sentiment, project activity, and network scalability.

It will be analyzed in this article of TopCoin9 through key aspects including live DOT value, supply metrics, price forecasts, and trusted platforms to track performance — helping you make informed decisions in a rapidly evolving crypto landscape.

What Is Polkadot (DOT)?

Polkadot is a next-generation blockchain platform founded by Ethereum co-founder Dr. Gavin Wood. It was developed by Parity Technologies and launched in May 2020 with the aim of enabling different blockchains to interoperate seamlessly via a shared security model and a system of “parachains” (parallel blockchains).

Unlike traditional blockchains, Polkadot enables multiple chains to connect and share data in a scalable, secure, and decentralized manner. The native token of the network, DOT, plays a vital role in governance, staking, and bonding parachains.

According to Cointelegraph (2024), Polkadot has consistently ranked among the top 15 cryptocurrencies by market cap, highlighting its relevance in the blockchain economy.

With a solid understanding of what Polkadot is, let’s now examine its market cap performance in 2025 through the content below!

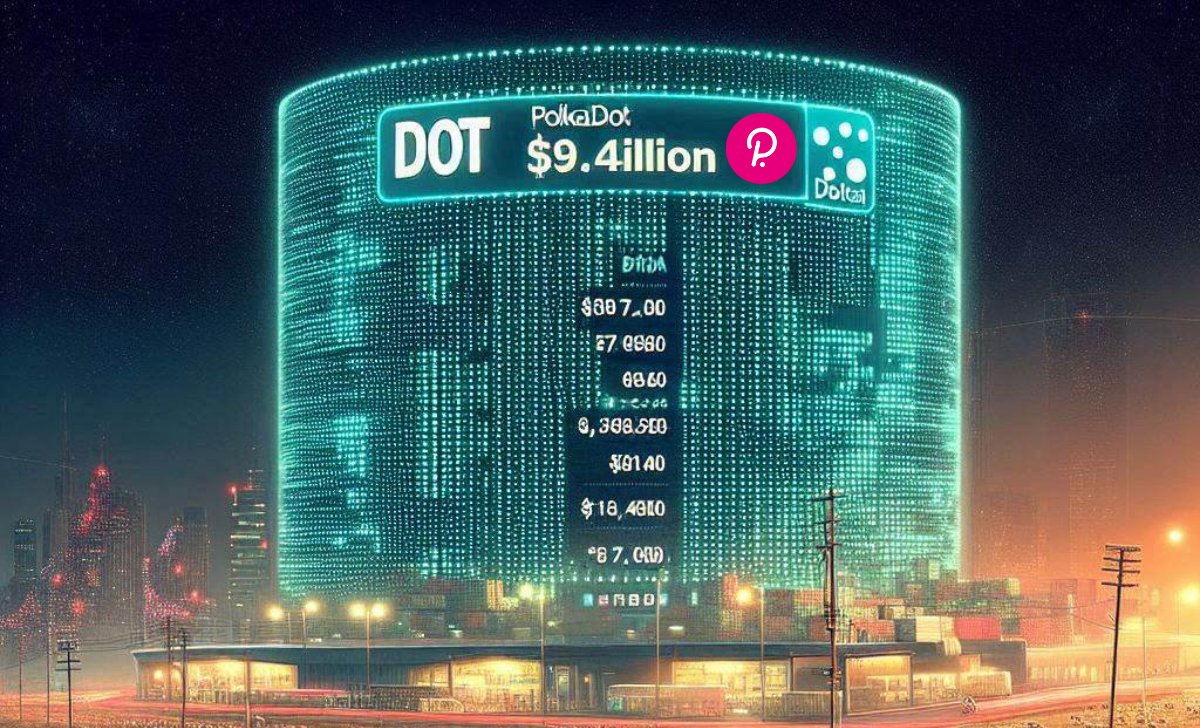

Polkadot Market Cap 2025: Current Trends

As of mid-2025, the Polkadot Market Cap stands at approximately $9.6 billion, according to live data from CoinMarketCap (2025). This positions DOT among the top 20 cryptocurrencies globally. Compared to its valuation of around $7 billion in early 2024, DOT has seen a moderate but steady recovery, supported by ecosystem development and new parachain auctions.

Key observations:

- DOT Price: $6.70 (as of June 2025)

- Circulating Supply: 1.4 billion DOT

- 24h Trading Volume: Over $350 million

Analysts at Messari (2025) highlight Polkadot’s strategic focus on scalability and governance as primary drivers of this growth. Furthermore, investor optimism around interoperability and modular blockchain design continues to push demand for DOT.

Beyond the current valuation, several metrics offer deeper insight into what’s powering DOT’s market cap. Let’s explore that in the next section!

Key Metrics Affecting DOT’s Market Cap

The Polkadot Market Cap is shaped by a variety of on-chain and off-chain factors, including:

- Circulation vs. Total Supply: While the total supply of DOT exceeds 1.3 billion, only the circulating supply impacts the market cap. Market Cap = Circulating Supply × DOT Price.

- Staking Participation: Over 53% of DOT tokens are staked as of Q2 2025 (source: Staking Rewards, 2025), reducing active circulation and applying upward pressure on price and perceived scarcity.

- Ecosystem Activity: New parachains such as Phala Network and Moonbeam continue to onboard users and developers. Each auction adds utility to the DOT token, fueling demand and valuation.

- Macro Trends: Trends in Web3, AI-blockchain integrations, and DeFi impact investor sentiment. According to Forbes (2025), increased institutional interest in cross-chain tech supports long-term projections for DOT.

Understanding these components helps investors better interpret the true meaning behind Polkadot’s market capitalization. But how should this influence your investment strategy? Details will be revealed in the content below!

How to Interpret Polkadot Market Cap for Investment

A cryptocurrency’s market cap tells us more than just its dollar value. It helps classify the coin as a large-cap, mid-cap or small-cap asset and influences the level of volatility or risk an investor might expect.

Why It Matters:

- Large Market Cap (>$10B): Considered more stable but slower-growing

- Mid Market Cap ($1B–$10B): Balanced growth and risk

- Small Cap (<$1B): High risk, high reward

With its market cap approaching $10 billion, Polkadot currently sits in the upper mid-cap range, making it attractive to both conservative and growth-focused investors. When evaluating options for the Best Crypto to Buy Now, understanding this classification is key.

However, market cap alone doesn’t paint the full picture. It should always be evaluated alongside volume trends, developer activity, staking rates, and tokenomics.

With investment potential in mind, let’s look at future predictions for Polkadot’s price and market cap trajectory in the next part!

Polkadot Price Prediction & Market Cap Forecast

According to multiple reputable sources, Polkadot (DOT) shows promising growth potential through 2025.

- DigitalCoinPrice (2025) forecasts DOT may trade between $9 and $12 by year-end, raising the Polkadot Market Cap to over $13 billion.

- In contrast, WalletInvestor (2025) offers a more conservative outlook, anticipating a 10–15% increase from current levels.

Key Drivers:

- Continuous onboarding of parachains, strengthening Polkadot’s scalability and interoperability.

- Rising institutional interest in modular blockchain frameworks (Forbes, 2025).

- Deployment of OpenGov v2, enhancing decentralized governance mechanisms (Polkadot Wiki, 2025).

Potential Risks:

- Tightening regulations in major jurisdictions such as the U.S. and EU (CoinDesk, 2024).

- Growing competition from similar interoperability platforms like Cosmos and Avalanche.

These projections underscore Polkadot’s evolving role in the Web3 ecosystem. However, active monitoring of its market cap and on-chain metrics remains crucial for informed investment decisions. Next, let’s explore the tracking tools in the content section below!

Where to Track Live Polkadot Market Cap & Metrics

To monitor Polkadot Market Cap in real time, investors can rely on several trusted platforms offering comprehensive data and analytics:

- CoinMarketCap: Provides live updates on DOT’s market cap, price, trading volume, and circulating supply. Widely used by retail and institutional investors alike (CoinMarketCap, 2025).

- CoinGecko: Offers in-depth tokenomics, historical market trends, and community metrics. Known for its accuracy and open-source approach (CoinGecko, 2025).

- Messari: Features institutional-grade insights, market intelligence, and advanced filters for on-chain data. Recommended for professional crypto analysis (Messari, 2025).

- TradingView: Delivers interactive price charts, technical indicators, and trading patterns in real time. Ideal for both technical traders and long-term investors (TradingView, 2025).

These platforms not only help users track Polkadot’s market cap and performance but also offer tools to compare metrics across other trending assets — such as real-time updates on Brett (Based) Price and market trends.

Conclusion

We hope this article has helped you better understand the Polkadot Market Cap and its key drivers in 2025. Stay informed and make smarter investment choices by keeping up with the latest updates in crypto space. Don’t forget to follow TopCoin9 for more in-depth insights and upcoming analyses.

Ethan Carter, a seasoned crypto analyst with 7+ years of experience, has a deep understanding of market trends, DeFi, and blockchain technologies. His expert insights and market forecasts have helped thousands of traders and investors make informed decisions.

Email: [email protected]