Impermanent loss is a risk when providing liquidity to DeFi pools, occurring when the prices of assets in the pool fluctuate, causing your investment value to be lower than simply holding the assets separately. The main causes are price volatility, exchange rate differences, and arbitrage activity; the greater the asset volatility, the higher the impermanent loss.

For example, if ETH rises sharply against USDC in a pool, you may end up with less ETH than expected. To minimize impermanent loss, prioritize stablecoin pairs, choose pools with higher fees, or use automated management tools. See the detailed analysis from TOPCOIN9 below to better understand and effectively mitigate this risk.

Definition of Impermanent Loss

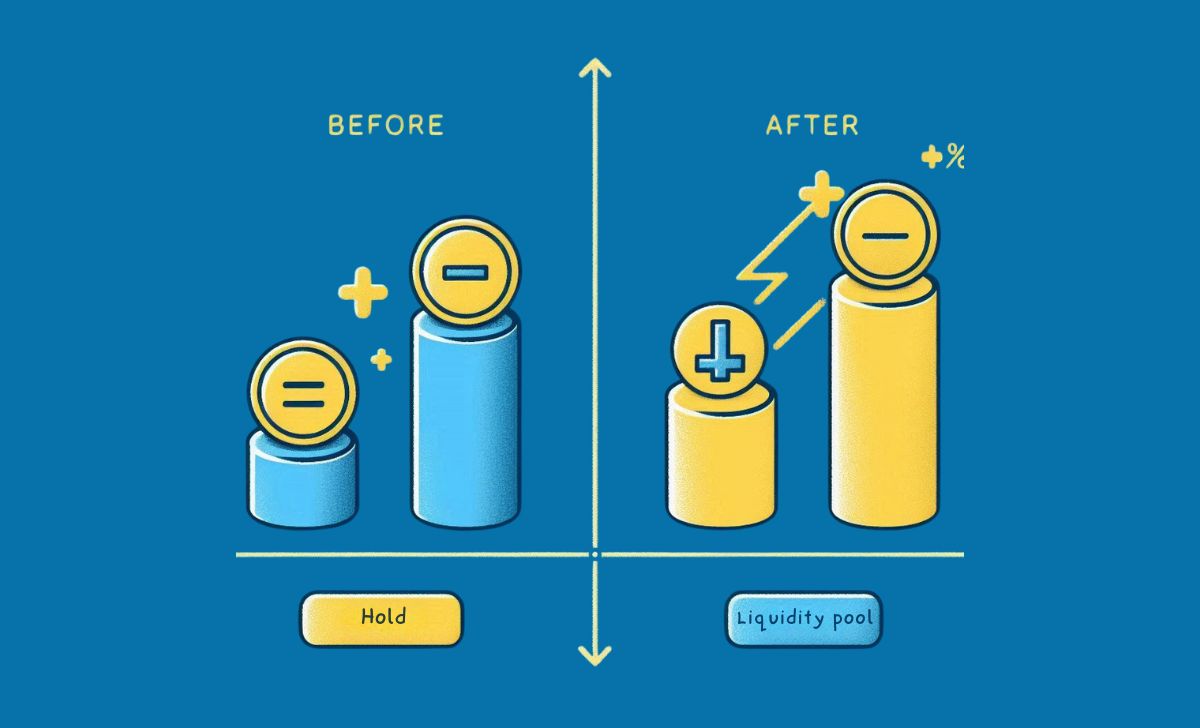

Impermanent loss is the risk faced by liquidity providers in decentralized exchanges when the price of deposited assets changes compared to when they were first added to the pool (Wikipedia, 2022; IOHK, 2022). It occurs when the total value of assets withdrawn from a liquidity pool is lower than if the provider had simply held the assets outside the pool (IOHK, 2022).

The term impermanent reflects that this loss may be temporary if asset prices return to their original levels, the loss can disappear. However, if assets are withdrawn when prices have diverged, the loss becomes permanent (IOHK, 2022).

Impermanent loss is a key consideration in automated market makers (AMMs) and constant function market makers (CFMMs), as it directly compares the value evolution of a liquidity provider’s position with that of a simple buy-and-hold strategy (Wikipedia, 2022).

On many modern DeFi platforms, blockchain technology ensures transparency and auditability for all liquidity pool transactions, helping users track value changes and better understand the risks of impermanent loss.

With a clear definition of impermanent loss in mind, it’s important to examine the key factors that influence the severity and likelihood of this phenomenon in DeFi.

Key Factors Affecting Impermanent Loss

The main factors impacting impermanent loss are price volatility, asset correlation, pool composition, and arbitrage activity (Gate.com, 2025; Metana, 2025).

- Price Volatility: The greater the price change of assets in a liquidity pool, the higher the risk of impermanent loss. Large price swings such as those seen with Bitcoin or Ethereum can significantly reduce the value of a liquidity provider’s position compared to simply holding the assets (Gate.com, 2025).

- Asset Correlation: Pools with highly correlated assets (e.g., stablecoin pairs like USDC/DAI) experience less impermanent loss, while pools with volatile or uncorrelated assets face greater risk (Metana, 2025).

- Arbitrage Opportunities: Arbitrage traders rebalance pools when asset prices diverge from external markets, often increasing impermanent loss for liquidity providers (Metana, 2025).

- Pool Composition and AMM Algorithm: The type of automated market maker (AMM) and the ratio of assets in the pool influence how sensitive the pool is to price changes and arbitrage, affecting the degree of impermanent loss (Metana, 2025).

- Duration of Liquidity Provision: The longer assets remain in a volatile pool, the greater the exposure to impermanent loss (Gate.com, 2025).

Understanding these key factors helps liquidity providers assess risk and make informed decisions when participating in DeFi pools (Gate.com, 2025; Metana, 2025).

After identifying the main factors, looking at real-world examples can help illustrate how impermanent loss occurs in practice.

Examples of Impermanent Loss

Impermanent loss occurs when the value of assets withdrawn from a liquidity pool is less than if the provider had simply held the assets, due to price changes and pool rebalancing (Wikipedia, 2022; Kraken, 2024).

- ETH/USDC Pool Example: Suppose you deposit 1 ETH (worth $100) and 100 USDC into a liquidity pool, totaling $200. If ETH’s price rises to $200, the pool rebalances, and your share becomes 0.7071 ETH and 141.42 USDC, worth about $282. If you had just held your assets, you’d have $300, resulting in an impermanent loss of $18 (Kraken, 2024; Tangem, 2023).

- AMM Arbitrage Example: In a constant function market maker (CFMM), if one asset appreciates significantly, arbitrage traders will swap assets to maintain the pool ratio, often increasing impermanent loss for liquidity providers (Wikipedia, 2022).

- Opportunity Cost: The loss is “impermanent” because it only becomes permanent if assets are withdrawn after price divergence. If prices revert, the loss may disappear (Duke University, 2025).

On Base DEX, a popular decentralized exchange on Ethereum Layer 2, many liquidity providers have experienced impermanent loss when supplying volatile token pairs, especially during periods of high market movement and arbitrage.

These examples highlight why understanding impermanent loss is crucial for anyone providing liquidity in DeFi pools (Wikipedia, 2022; Kraken, 2024; Tangem, 2023).

By understanding these examples, you’ll be better prepared to explore effective mitigation strategies that can help reduce the impact of impermanent loss on your investments.

Mitigation Strategies for Impermanent Loss

Mitigating impermanent loss is essential for DeFi liquidity providers, and several proven strategies can help reduce risk and protect returns (Fintechreview, 2025; Nadcab Labs, 2025).

- Provide Liquidity to Stable or Correlated Asset Pools: Choosing pools with stablecoins (e.g., USDC/DAI) or highly correlated assets (like ETH/stETH) minimizes price divergence and reduces impermanent loss (Fintechreview, 2025; Nadcab Labs, 2025).

- Use Protocols with Impermanent Loss Protection: Some DeFi platforms (such as Bancor and Thorchain) offer insurance-like mechanisms or compensation for impermanent loss, especially for long-term liquidity providers (Fintechreview, 2025).

- Diversify Across Multiple Pools: Spreading investments across different pools and asset types helps balance potential losses, reducing the impact from any single volatile pair (Nadcab Labs, 2025).

- Monitor and Adjust Positions Dynamically: Using analytics tools to track pool performance and rebalancing regularly can limit exposure to high volatility and optimize returns (Nadcab Labs, 2025).

- Leverage Trading Fees and Incentives: High-fee pools or those with additional rewards can offset impermanent loss, making liquidity provision more attractive even in volatile markets (Fintechreview, 2025; Soma Finance, 2025).

- Stay Informed and Educated: Understanding pool mechanics, using impermanent loss calculators, and keeping up with DeFi protocol updates are crucial for effective risk management (Nadcab Labs, 2025; Soma Finance, 2025).

By combining these strategies, liquidity providers can better manage risk and achieve more stable returns in the evolving DeFi landscape (Fintechreview, 2025; Nadcab Labs, 2025).

Impermanent loss remains a critical risk for DeFi liquidity providers, but understanding its causes and mitigation strategies can help protect your assets. By choosing the right pools and staying informed, investors can optimize returns while minimizing exposure. For the latest DeFi insights and expert tips on managing impermanent loss, follow TOPCOIN9.

Sophia Mitchell is a passionate crypto educator with 6+ years of experience in blockchain training and community building. She has led educational initiatives for major crypto platforms and now empowers the TopCoin9 audience with valuable insights into Web3, staking, and DeFi.

Email: [email protected]