Bitcoin halving is one of the most anticipated events in the cryptocurrency world, triggering significant changes to the Bitcoin network every four years. It reduces the block rewards that miners receive, effectively slowing the creation of new bitcoins and reinforcing the digital currency’s scarcity.

But what exactly is Bitcoin halving, and when is the next one set to happen? This is article, TopCoin9 explores everything you need to know about this pivotal event.

What is Bitcoin Halving?

Bitcoin halving is a pre-programmed event in the Bitcoin network that cuts the reward for mining new blocks in half. This process occurs approximately every four years, or after every 210,000 blocks are mined. The purpose of halving is to reduce the rate at which new bitcoins are created, effectively limiting the supply over time and introducing scarcity much like precious metals such as gold.

When Bitcoin launched in 2009, miners received 50 BTC per block. After the first halving in 2012, this reward was reduced to 25 BTC, then to 12.5 BTC in 2016, and most recently to 6.25 BTC in 2020. The next halving will lower the reward to 3.125 BTC. By gradually reducing the issuance of new coins, Bitcoin halving helps ensure the total supply will never exceed 21 million BTC, making it a deflationary asset.

Now that you understand what Bitcoin halving is, let’s take a closer look at how it actually works.

How does Bitcoin Halving work?

Bitcoin halving is built into the protocol of the Bitcoin blockchain. The network is programmed to halve the mining reward every 210,000 blocks, which roughly translates to once every four years. This mechanism is designed to maintain a predictable supply schedule and ensure that the total number of bitcoins in circulation approaches, but never exceeds, the 21 million cap.

The halving occurs automatically once the blockchain reaches the next halving block. For example, if the last halving occurred at block 630,000, the next one would happen at block 840,000. Miners will then receive half the reward for verifying transactions and adding them to the blockchain.

This decrease in rewards can have major effects on the mining ecosystem. While it reduces the revenue miners earn per block, it also typically leads to increased interest from investors due to the resulting scarcity of new bitcoins entering the market.

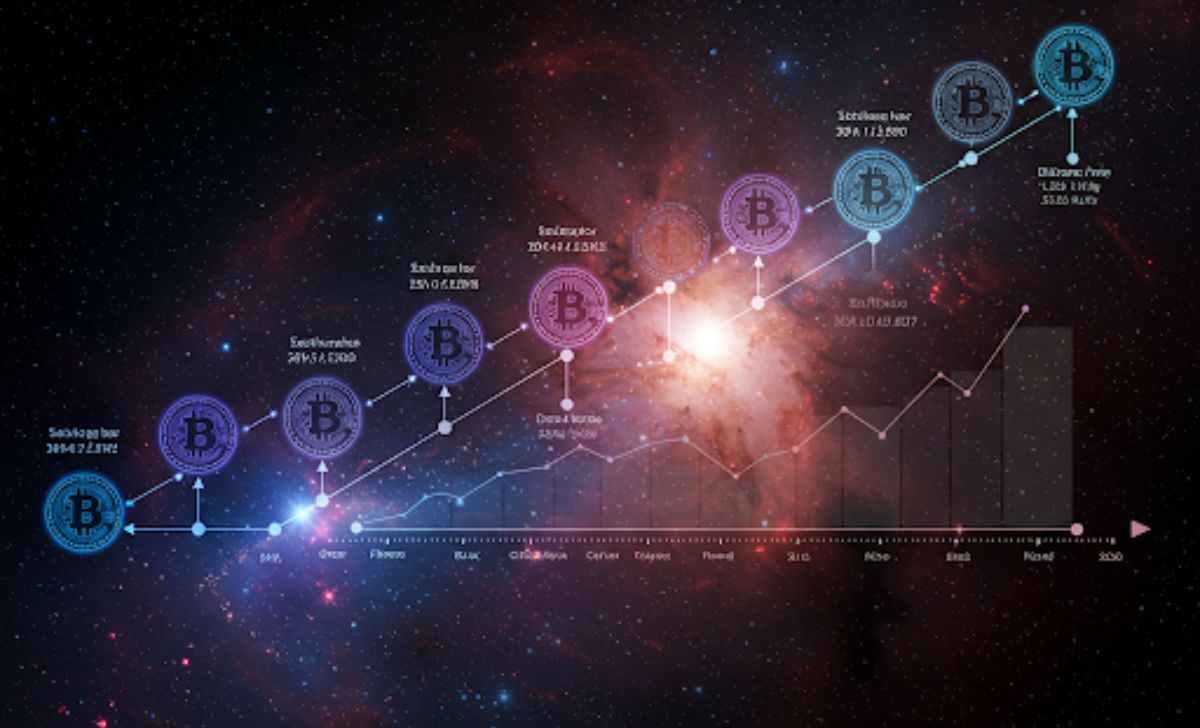

A look back at previous Bitcoin Halving

To understand the potential impact of the upcoming halving, it’s helpful to review what happened during previous Bitcoin halving events. There have been three halvings so far—each marking a significant turning point in Bitcoin’s journey.

First Halving – November 28, 2012

Block reward dropped from 50 BTC to 25 BTC. Around this time, Bitcoin was trading at approximately $12. One year later, it surged past $1,000 for the first time.

Second Halving – July 9, 2016

The reward was cut from 25 BTC to 12.5 BTC. Bitcoin’s price was around $650 during the halving and rose to nearly $20,000 by the end of 2017.

Third Halving – May 11, 2020

The reward dropped from 12.5 BTC to 6.25 BTC. Bitcoin’s price hovered around $8,500 at the time but climbed to an all-time high of over $69,000 by late 2021.

Each of these events triggered a significant reduction in the rate of new bitcoin issuance, contributing to bullish market trends in the months and years that followed. However, it’s important to remember that past performance is not a guarantee of future results.

With that in mind, let’s explore what the next halving could bring.

Bitcoin Halving 2024 – What to expect?

The next Bitcoin halving 2024 is projected to occur around April 2024, at block number 840,000. This event will reduce the mining reward from 6.25 BTC to 3.125 BTC per block. As with previous halvings, the crypto community is filled with anticipation—and speculation—about its potential effects.

While no one can predict the market with certainty, analysts and enthusiasts alike are closely watching the bitcoin halving countdown, tracking every block that gets us closer to this major event. The 2024 halving is especially significant because it comes at a time when institutional interest in Bitcoin is growing, and global regulations are evolving rapidly.

Will Bitcoin repeat its historic pattern of price increases after the halving? Or will macroeconomic factors change the game this time? Let’s dive deeper into the expectations, market sentiment, and strategies for 2024 in the next sections.

When is the Next Bitcoin Halving?

If you’re wondering when is Bitcoin halving scheduled to happen next, the answer lies in the Bitcoin blockchain’s block height. The next Bitcoin halving date is projected to occur around April 2024, when the network reaches block 840,000. However, this date isn’t set in stone it depends on the pace at which new blocks are mined.

To help track this countdown, several websites and tools provide a Bitcoin halving countdown, updating in real-time based on block generation speed. These countdowns not only build anticipation but also serve as important planning tools for investors and miners alike.

As the halving approaches, the crypto space typically sees increased media attention, heightened speculation, and shifting investor behavior. But why does it matter so much? What is it about Bitcoin halving that makes the markets react so strongly?

Let’s explore the reasons behind its significance.

Why Bitcoin Halving Matters for investors?

Bitcoin halving directly impacts the supply side of Bitcoin’s economic model, making it one of the most influential factors in long-term price dynamics. By reducing the rate at which new bitcoins are introduced into circulation, halving events introduce scarcity, a concept that historically leads to higher asset values when demand remains constant or increases.

For investors, this scarcity often translates into a bullish outlook. Past halvings have been followed by strong price rallies, leading many to adopt a “buy and hold” strategy months before the event. Although price increases are never guaranteed, historical patterns suggest that halvings can act as catalysts for new market cycles.

Moreover, halvings also affect miner profitability, which can lead to changes in network hash rate and mining difficulty two technical factors that seasoned investors often watch closely.

Understanding the mechanics and implications of Bitcoin halving can provide investors with a strategic edge, especially in a market known for its volatility. In the next section, we’ll look at how you can prepare for this event and what steps to consider before and after the 2024 halving.

How to prepare for the Bitcoin Halving?

With the Bitcoin halving 2024 on the horizon, both seasoned investors and crypto newcomers are looking for ways to prepare strategically. While no one can predict market movements with 100% accuracy, there are several smart steps you can take to be ready for this major event:

- Stay Informed and Track the Countdown: Keep an eye on a trusted Bitcoin halving countdown to know exactly when the event will happen. Staying informed allows you to make timely investment decisions and adjust your strategy accordingly.

- Understand the Market Cycles: Historically, each bitcoin halving has triggered a new bullish cycle months after the event. Study past price movements and market behavior to better understand what could happen next—but remember, past performance is not a guarantee of future results.

- Review Your Investment Portfolio: Now is a good time to reassess your portfolio. Are you holding enough BTC? Are you overexposed? Halving events can bring increased volatility, so ensure your risk level matches your investment goals.

- Consider Dollar-Cost Averaging (DCA): Instead of trying to time the market, many investors use the DCA strategy—investing a fixed amount in Bitcoin at regular intervals. This helps reduce the impact of price volatility before and after the halving.

- Follow On-Chain and Miner Data: Monitor hashrate, miner behavior, and exchange inflows/outflows to gauge market sentiment. Post-halving periods may see some miners leave the network due to lower profitability, which can affect short-term price action.

Preparing for the next halving isn’t just about predicting the price—it’s about positioning yourself for long-term success in the crypto market. Whether you’re a long-term HODLer or a short-term trader, planning ahead can make a significant difference.

Conclusion

The upcoming Bitcoin halving 2024 is more than just a technical event—it’s a milestone that could reshape the market landscape. By understanding how it works, reviewing past trends, and preparing with a solid strategy, investors can navigate the halving with confidence. Whether you’re holding for the long term or planning your next move, staying informed is key to making the most of this pivotal moment in Bitcoin’s journey.

With over a decade of experience in finance and blockchain, David Anderson has been a key figure in the crypto space, contributing to top publications like CoinDesk. As the Founder & Editor-in-Chief of TopCoin9, he is dedicated to providing accurate, insightful, and cutting-edge analysis of the crypto market.

Email: [email protected]