Bonk Coin (BONK) is a standout memecoin on Solana with a total supply of nearly 100 trillion tokens, over 50% of which have been airdropped to the community, while the remainder is allocated to projects, development teams, and the DAO fund. BONK’s tokenomics prioritize transparency, fair distribution, and deep integration with the DeFi and NFT ecosystem on Solana.

BONK is used for trading, staking, fee payments, and community activities. For detailed updates on supply and the latest changes, check out the analysis from TOPCOIN9 below.

Bonk Total Supply – Key Figures and Circulating Data

Bonk (BONK) is a meme token on the Solana blockchain with a fixed, transparent supply structure designed to drive community engagement and ecosystem growth (CoinMarketCap, 2025; Binance, 2025).

- Maximum Supply: BONK has a capped maximum supply ranging from approximately 88.8 trillion to 93 trillion tokens, depending on the source and recent burn events (CoinMarketCap, 2025; Binance, 2025; MEXC, 2025).

- Current Total Supply: As of June 2025, the total supply is reported at around 88.8 trillion BONK, reflecting ongoing token burns that reduce the available supply (CoinMarketCap, 2025; MEXC, 2025).

- Circulating Supply: The circulating supply is approximately 78.6–80 trillion BONK, representing tokens available on the market and held by the public (CoinMarketCap, 2025; Binance, 2025; Flitpay, 2025).

- Token Burns: Regular token burns are conducted to decrease supply and support price stability, with notable burns removing billions of BONK from circulation (Capital.com, 2023; MEXC, 2025).

- Distribution Highlights: BONK’s initial supply was distributed through airdrops to the Solana community, including NFT projects, artists, developers, and market participants, ensuring broad and decentralized ownership (Flitpay, 2025; CoinMarketCap, 2025).

- Market Cap and Ranking: BONK’s market capitalization has reached nearly $1 billion, ranking it among the top 70 cryptocurrencies by market cap (CoinMarketCap, 2025; Binance, 2025).

This transparent approach to supply and circulation, combined with regular burns and community distribution, underpins BONK’s position as a leading community-driven token on Solana (CoinMarketCap, 2025; Capital.com, 2023; Flitpay, 2025).

Now that you have a clear picture of Bonk’s total supply, circulating figures, and deflationary mechanisms, let’s take a closer look at how tokens are allocated and distributed within the community.

Token Allocation and Community Distribution

Bonk (BONK) implements a transparent and community-focused token allocation, with half of its total supply distributed via airdrops to the Solana ecosystem (Binance, 2025; Flitpay, 2025; Capital.com, 2023).

- Airdrop Allocation: 50% of the total supply (about 44.43 trillion BONK) was airdropped to the Solana community, targeting NFT holders, DeFi users, traders, validators, and developers (Binance, 2025; Flitpay, 2025).

- Detailed Distribution:

- 21% to Solana NFT projects

- 16% to DeFi users and market participants

- 10% to NFT artists and collectors

- 5% to Solana developers

- 21% to early contributors (with a vesting period)

- 16% to Bonk DAO

- 5% for initial liquidity on DEXs and DeFi protocols

- 5% for marketing and ecosystem growth (Flitpay, 2025; Capital.com, 2023)

- Community Emphasis: This broad airdrop strategy ensures decentralized ownership, strengthens community engagement, and aligns incentives across the Solana network (Binance, 2025; Flitpay, 2025).

- DAO Participation: 16% of the supply is managed by Bonk DAO, allowing token holders to participate in governance and future development (Flitpay, 2025).

- Ongoing Burns: The Bonk team periodically burns tokens to help regulate supply and support the token’s value (Flitpay, 2025).

This allocation model highlights Bonk’s commitment to decentralization, transparency, and empowering the Solana community (Binance, 2025; Flitpay, 2025; Capital.com, 2023).

After understanding the allocation and distribution strategies, it’s important to examine Bonk’s tokenomics and economic model to see how these elements drive long-term value and sustainability.

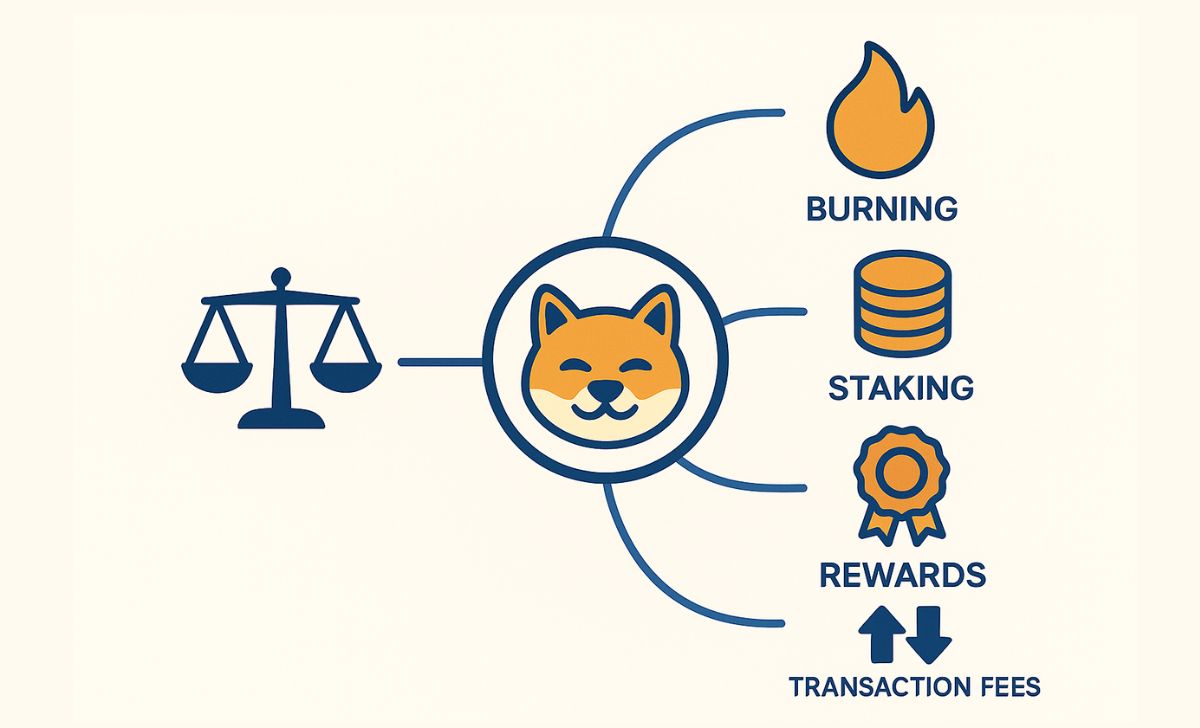

Tokenomics and Economic Model

Bonk features a fixed-supply, deflationary tokenomics model designed to incentivize community engagement and long-term sustainability (Wikipedia, 2022; MEXC, 2025; BonkBot, 2025).

- Fixed Maximum Supply: BONK has a capped supply of approximately 93.56 trillion tokens, with no ongoing minting or inflation. All tokens were created at genesis, ensuring supply transparency and scarcity (MEXC, 2025; Wikipedia, 2022).

- Deflationary Burn Mechanism: BONK employs regular token burns, including a portion of trading fees from BonkBot (10%) that are automatically burned, reducing both circulating and total supply over time. This deflationary approach is designed to increase scarcity and potentially support price appreciation (MEXC, 2025; Margex, 2024).

- Community-Centric Distribution: BONK’s allocation favors airdrops and ecosystem incentives, with no public or private token sale. Major allocations include airdrops to Solana users, NFT projects, DeFi participants, and DAO-controlled community initiatives (MEXC, 2025).

- Staking and Incentives: Holders can participate in staking and liquidity provision, earning esBONK rewards that can be converted to BONK over time, further encouraging ecosystem participation (MEXC, 2025).

- Vesting and Lockup: Early contributors are subject to a 3-year linear vesting schedule, while most airdropped tokens have no lockup, supporting immediate community liquidity (MEXC, 2025).

- No On-chain Governance: Unlike some tokens, BONK does not confer voting rights or profit-sharing, and its value is driven primarily by utility, community activity, and market sentiment (MEXC, 2025; Wikipedia, 2022).

- Centralization Risk: As of June 2025, the top 10 wallets hold about 35% of total supply, which may present concentration risks despite the project’s community focus (MEXC, 2025).

This structured economic model blends aggressive community distribution, meaningful burn mechanics, and robust staking incentives, but users should remain aware of centralization risks and the speculative nature of memecoins (Wikipedia, 2022; MEXC, 2025; BonkBot, 2025).

With these tokenomics and incentive structures in mind, let’s move on to recent updates and ecosystem developments that are shaping Bonk’s growth and market performance.

Recent Updates and Ecosystem Developments

Bonk has experienced significant ecosystem growth, frequent token burns, and new integrations, reinforcing its role as a leading community-driven token on Solana (Flitpay, 2025; OKX, 2025; CoinMarketCap, 2024).

- Ongoing Token Burns: BONK regularly conducts large-scale token burns to reduce total and circulating supply, supporting price stability and scarcity. Notably, in December 2024, the BONK DAO burned 1.69 trillion tokens (about $52 million), representing 1.8% of total supply (CoinMarketCap, 2024; Binance, 2024; OKX, 2025).

- Current Supply Metrics: As of April–June 2025, BONK’s total supply stands at approximately 88.8 trillion tokens, with a circulating supply of 77.4–78.6 trillion, reflecting recent burn events (Flitpay, 2025; OKX, 2025).

- Ecosystem Integrations: BONK is now integrated with over 140 defi apps, NFT platforms, gaming projects, and wallets on Solana, including tools like BonkBot (trading), BONKSwap (DEX), Bonk Scooper (wallet cleaner), and Moonwalk (fitness rewards), expanding real-world utility (OKX, 2025; Flitpay, 2025).

- Community and DAO Developments: 16% of BONK supply is managed by the BONK DAO, enabling token holders to participate in governance and development decisions. Recent community milestones, such as the “BURNmas” initiative, have increased engagement and transparency (Flitpay, 2025; OKX, 2025).

- Strategic Partnerships: In May 2025, Bonk partnered with DeFi Development Corp. to jointly manage a Solana validator node, marking a new level of collaboration between public companies and community tokens (Blockhead, 2025).

- Market Impact: Despite major burns, BONK’s price can be volatile; for example, the December 2024 burn was followed by a 7% price drop, highlighting the influence of community sentiment and execution timing (CoinMarketCap, 2024).

These updates demonstrate BONK’s commitment to deflationary supply management, ecosystem expansion, and active community governance, solidifying its position in the Solana and broader Web3 landscape (Flitpay, 2025; OKX, 2025; Binance, 2024).

Having reviewed the latest ecosystem expansions and market trends, let’s conclude with a summary of key takeaways and a look at the future outlook for Bonk in the evolving crypto landscape.

Conclusion and Future Outlook

Bonk (BONK) stands out as a community-driven meme coin with a transparent total supply, deflationary tokenomics, and deep integration in the Solana ecosystem (MEXC, 2025; 99Bitcoins, 2024; Wikipedia, 2022). The project’s capped supply nearly 100 trillion tokens and ongoing token burns contribute to scarcity and may support long-term price stability (MEXC, 2025; Economic Times, 2025).

Looking ahead, analysts predict BONK could see continued upward momentum if its ecosystem expands, utility increases, and community engagement remains strong (Economic Times, 2025; Cryptonews, 2025; Bitrue, 2025). However, as with all meme coins, BONK’s price is subject to high volatility, broader market trends, and regulatory shifts, making it a speculative investment (99Bitcoins, 2024; Cryptonews, 2025).

Sustained growth will depend on Bonk’s ability to deliver new use cases in DeFi, NFTs, and gaming, while maintaining transparency and active community participation key factors for long-term relevance in the evolving crypto landscape (MEXC, 2025; Wikipedia, 2022; Economic Times, 2025).

Bonk’s total supply and transparent allocation have positioned it as a standout community-driven token on Solana, with regular burns and ecosystem growth supporting its long-term value. Price forecasts for 2025 suggest BONK could reach an average of $0.000017, fueled by Solana’s expansion and active community engagement, though volatility remains a key risk. For the latest updates, expert analysis, and real-time insights on Bonk and the crypto market, follow TOPCOIN9.

Sophia Mitchell is a passionate crypto educator with 6+ years of experience in blockchain training and community building. She has led educational initiatives for major crypto platforms and now empowers the TopCoin9 audience with valuable insights into Web3, staking, and DeFi.

Email: [email protected]