OKX is one of the world’s leading cryptocurrency exchanges, offering a wide range of trading services, including spot, futures, and margin trading. Founded with the vision of providing a secure and efficient trading environment, OKX has grown into a trusted platform for millions of users worldwide.

With competitive fees, diverse asset offerings, and innovative trading tools, it caters to both beginners and experienced traders. In this article, TopCoin9 will explore the key features of OKX, including its supported cryptocurrencies, trading options, fees, security measures, and how to get started.

What is OKX?

OKX is a globally recognized cryptocurrency exchange that provides a comprehensive suite of trading services, including spot trading, futures, options, and decentralized finance (DeFi) products. Known for its user-friendly interface and advanced trading tools, OKX has attracted millions of traders worldwide. The platform supports a vast selection of cryptocurrencies, competitive fees, and robust security measures, making it a preferred choice for both beginners and professional traders.

Beyond its trading features, OKX is backed by a strong corporate foundation with a clear mission to drive the future of digital finance. To better understand its growth and credibility, let’s take a closer look at the company’s background, including its founding history, headquarters, and regulatory standing.

Company Background

OKX was founded in 2017 with the goal of providing a secure and efficient cryptocurrency trading platform for global users. Since its inception, the exchange has rapidly expanded, establishing itself as one of the top players in the crypto industry.

Headquarters and offices

OKX is headquartered in Seychelles, a strategic location that allows the company to operate globally while adhering to international regulatory standards. In addition to its main office, OKX has regional branches and operational teams in various countries, ensuring a strong presence in key financial markets across Asia, Europe, and beyond.

Key people behind OKX

The success of OKX is driven by a team of experienced professionals with deep expertise in blockchain technology and financial services. The platform was initially founded by Star Xu, a prominent figure in the crypto industry. Over the years, OKX has built a strong leadership team that focuses on innovation, security, and regulatory compliance to enhance the user experience and maintain its competitive edge.

Regulatory compliance and licenses

As a global exchange, OKX operates in compliance with various international regulatory frameworks. While it is headquartered in Seychelles, the platform actively engages with regulatory bodies in different jurisdictions to ensure adherence to legal requirements. OKX also implements strict Know Your Customer (KYC) and Anti-Money Laundering (AML) policies to enhance security and transparency. By maintaining compliance with global financial regulations, OKX continues to strengthen its credibility and trust among users worldwide.

With a solid foundation and a commitment to regulatory compliance, OKX has positioned itself as a reliable and innovative cryptocurrency exchange. Next, let’s explore the diverse range of cryptocurrencies and trading pairs available on the platform.

Supported Cryptocurrencies and Trading Pairs

OKX offers a vast selection of cryptocurrencies, catering to both mainstream and niche traders. The platform supports major digital assets such as Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and Solana (SOL), along with a wide range of altcoins, including emerging tokens from new blockchain projects. This diverse asset selection enables traders to explore various investment opportunities within the crypto ecosystem.

In addition to spot trading, OKX provides numerous trading pairs across different markets. Users can engage in crypto-to-crypto, crypto-to-stablecoin, and fiat-to-crypto trading pairs, offering flexibility in portfolio management. The exchange also lists perpetual contracts and futures trading pairs, allowing users to leverage advanced trading strategies.

With such an extensive range of assets and trading options, OKX ensures a dynamic trading experience for both beginners and professionals. However, before engaging in trading, it’s crucial to understand the platform’s fee structure, including trading fees, withdrawal costs, and potential additional charges. Let’s take a closer look at the fees and charges on OKX.

Fees and Charges on OKX

Below is the latest fee schedule for the OKX exchange based on the most recent data I can access. Note that OKX trading fees are tiered based on 30-day trading volume and total asset holdings, applicable to both regular users and VIPs. Fees are categorized into Maker (order creators) and Taker (order takers).

Spot Trading Fees

Spot trading fees are determined by account tier, including regular users and VIPs. Here’s a typical fee breakdown:

Regular Users:

Level 1: Trading volume < 1,000,000 USD

- Maker: 0.08%

- Taker: 0.10%

Level 2: Trading volume 1,000,000 – 5,000,000 USD

- Maker: 0.07%

- Taker: 0.09%

Level 3: Trading volume 5,000,000 – 10,000,000 USD

- Maker: 0.06%

- Taker: 0.08%

VIP Users

VIP 1: Trading volume 10,000,000 – 20,000,000 USD or total assets ≥ 100,000 USD

- Maker: 0.06%

- Taker: 0.08%

VIP 2: Trading volume 20,000,000 – 50,000,000 USD or total assets ≥ 500,000 USD

- Maker: 0.04%

- Taker: 0.06%

VIP 3: Trading volume 50,000,000 – 100,000,000 USD or total assets ≥ 1,000,000 USD

- Maker: 0.03%

- Taker: 0.05%

VIP 4 and above: Depending on trading volume and assets, Maker fees can go negative (e.g., -0.005%), and Taker fees can drop to 0.02%.

Futures Trading Fees

Futures trading fees (including perpetual and fixed-term contracts) are also tiered:

Regular Users:

Level 1: Trading volume < 10,000,000 USD

- Maker: 0.02%

- Taker: 0.05%

Level 2: Trading volume 10,000,000 – 50,000,000 USD

- Maker: 0.015%

- Taker: 0.04%

VIP Users:

VIP 1: Trading volume 50,000,000 – 100,000,000 USD

- Maker: 0.01%

- Taker: 0.03%

VIP 4 and above: Maker fees can drop to -0.002%, and Taker fees to 0.015%.

Options Trading Fees

- Maker: Typically ranges from 0.02% to 0.015%.

- Taker: Typically ranges from 0.03% to 0.02%, depending on VIP tier.

Deposit and Withdrawal Fees

Deposit Fees: Free for all cryptocurrencies.

Withdrawal Fees: Vary by cryptocurrency and blockchain network. Examples:

- Bitcoin (BTC): ~0.0002 BTC

- Ethereum (ETH): ~0.001 ETH

- USDT (ERC-20): ~3-5 USDT

- (Check the withdrawal page on OKX for exact fees, as they fluctuate with network costs.)

After referring to the detailed fee schedule. The next part invites you to see the outstanding features of the OKX cryptocurrency exchange.

OKX Trading Features

OKX provides a comprehensive suite of trading features designed to meet the needs of both beginners and professional traders. Whether you’re looking for simple spot trading or advanced derivatives trading, OKX offers a robust and user-friendly platform with powerful tools to enhance your trading experience.

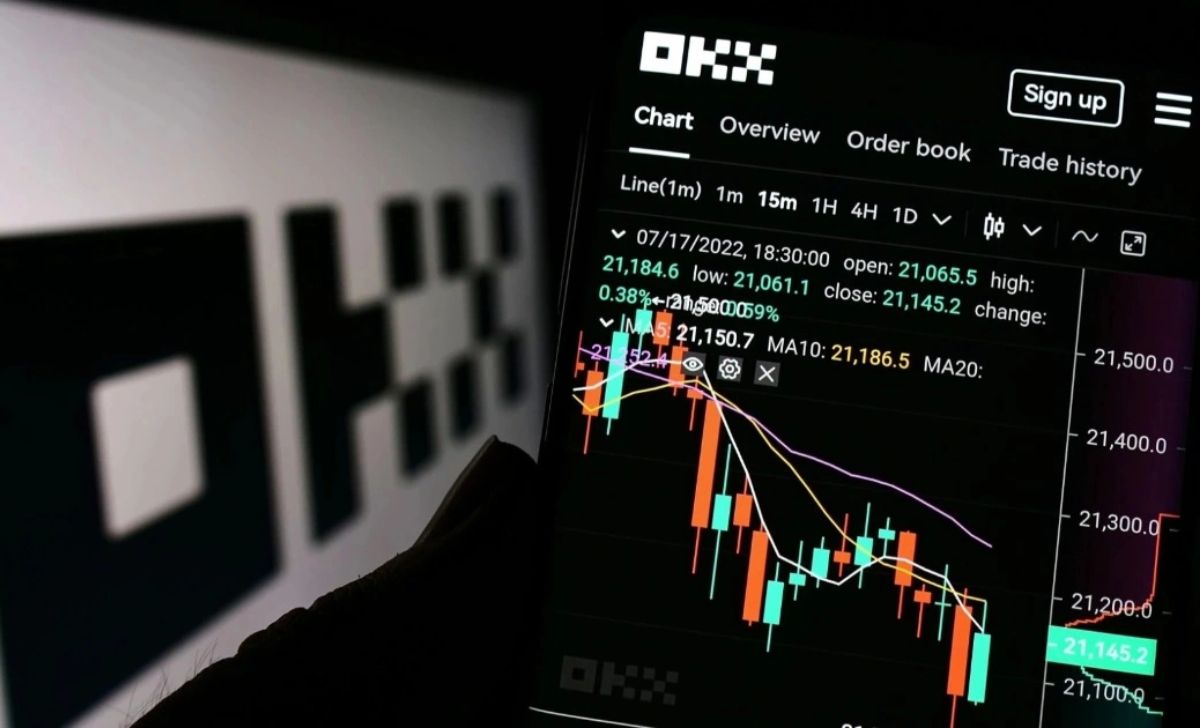

Spot Trading

Spot trading on OKX allows users to buy and sell cryptocurrencies at real-time market prices. The platform supports a wide range of trading pairs, enabling seamless transactions between major coins, stablecoins, and altcoins. Traders can choose from different order types, such as market, limit, and stop-limit orders, to optimize their trading strategies.

Futures and Derivatives Trading

For those looking to trade with leverage, OKX offers futures contracts, perpetual swaps, and options trading. These financial instruments enable traders to speculate on price movements, hedge their positions, and take advantage of market volatility. With leverage options available, users can maximize potential returns, though it’s important to manage risks effectively.

Margin Trading

OKX provides margin trading with competitive leverage, allowing traders to borrow funds and amplify their positions. This feature is ideal for experienced traders seeking to increase their market exposure. However, margin trading comes with higher risks, and users should apply proper risk management strategies to avoid liquidation.

OKX Earn and Staking

Beyond trading, OKX allows users to earn passive income through staking and lending programs. With OKX Earn, users can participate in fixed and flexible staking pools, earning rewards on various cryptocurrencies. Additionally, OKX offers yield-generating products such as DeFi staking and savings plans, enabling users to grow their crypto holdings over time.

Copy Trading and Trading Bots

OKX features an advanced copy trading system, where users can follow and replicate the strategies of professional traders. This is particularly useful for beginners who want to learn from experienced investors. Additionally, OKX provides automated trading bots that allow users to execute pre-set strategies without constant monitoring, making trading more efficient and less time-consuming.

With these diverse trading options and earning opportunities, OKX ensures a seamless and dynamic trading experience. If you’re ready to explore the platform, the next step is to understand how to get started on OKX, from account registration to making your first trade.

How to Get Started on OKX

Getting started on OKX is a straightforward process, whether you’re a beginner entering the crypto market or an experienced trader looking for advanced tools. Follow these steps to create an account, fund your wallet, and make your first trade.

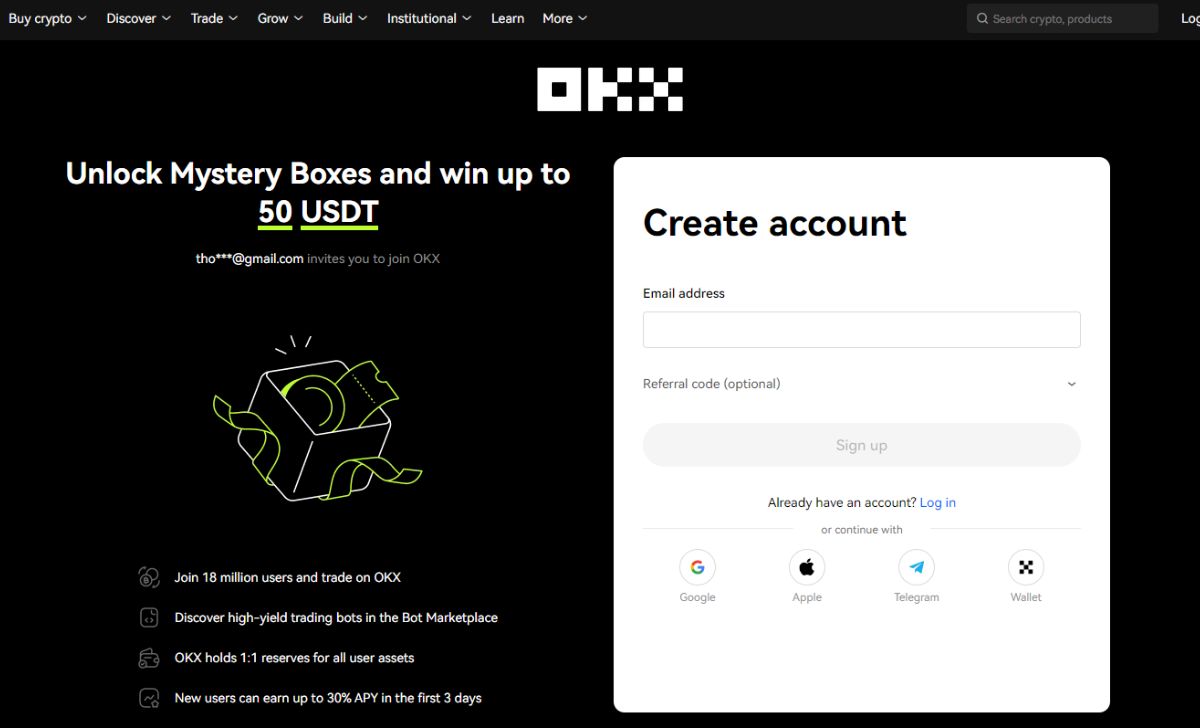

Account Registration

To begin using OKX, you need to create an account:

- Visit OKX on the Website – And click on the Sign Up button.

- Enter Your Details – Provide your email address or phone number and create a strong password.

- Verify Your Identity – To comply with security regulations, OKX may require Know Your Customer (KYC) verification. This involves submitting a valid ID and proof of residence. Completing KYC unlocks higher withdrawal limits and additional trading features.

- Enable Security Features – Set up two-factor authentication (2FA) to enhance your account security.

Once your account is verified, you can start depositing funds and trading on the platform.

Depositing Funds

After setting up your account, the next step is to fund your OKX wallet:

- Crypto Deposits – Transfer cryptocurrencies from another wallet or exchange by selecting your preferred asset and copying the deposit address.

- Fiat Deposits – OKX supports fiat deposits via bank transfers, credit/debit cards, and third-party payment services. Some methods may vary depending on your location.

- P2P Trading – If direct fiat deposits are not available, users can buy crypto through peer-to-peer (P2P) trading, where they transact directly with other users using local payment methods.

Making Your First Trade

Once your account is funded, you can start trading:

- Go to the Trading Section – Choose Spot Trading, Futures, or Margin Trading depending on your strategy.

- Select a Trading Pair – Pick from hundreds of available trading pairs (e.g., BTC/USDT, ETH/USDT).

- Choose an Order Type – Market orders execute instantly at the best price, while limit orders allow you to set your preferred price.

- Confirm and Execute – Enter the amount you wish to trade and confirm the transaction. Your assets will be updated in your wallet accordingly.

With your first trade completed, you’re now ready to explore the full potential of OKX. However, like any exchange, OKX has its strengths and weaknesses. In the next section, we will analyze the pros and cons of OKX to help you decide if it’s the right platform for your trading needs.

Pros and Cons of OKX

Like any cryptocurrency exchange, OKX has its advantages and disadvantages. While it offers a wide range of features and a strong security framework, there are also certain drawbacks that users should be aware of before trading.

Pros

OKX exchange has the following outstanding advantages:

- A wide selection of Cryptocurrencies – OKX supports a vast range of digital assets, including major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and numerous altcoins.

- Advanced Trading Features – The platform offers spot trading, futures, options, margin trading, and automated trading bots, catering to both beginners and professional traders.

- Competitive Trading Fees – OKX provides a tiered fee structure with low trading fees, which can be further reduced based on trading volume and OKB token holdings.

- High Liquidity – As one of the largest exchanges by trading volume, OKX offers deep liquidity, ensuring smooth order execution with minimal slippage.

- Strong Security Measures – OKX employs multi-layer security protocols, including cold storage, two-factor authentication (2FA), and anti-phishing measures to protect user funds.

- OKX Earn and Staking Opportunities – Users can earn passive income through staking, DeFi lending, and savings products.

Besides, OKX still has some limitations. Please follow below.

Cons

OKX exchange has some of the following disadvantages:

- Limited Fiat Support – Direct fiat deposits and withdrawals are not available in all regions, requiring users to rely on third-party services or P2P trading.

- Complex for Beginners – While OKX offers a wide range of trading tools, beginners may find features like margin trading and derivatives trading challenging to navigate.

- Regulatory Uncertainty – Since OKX operates globally, regulatory restrictions in certain countries may affect access to some services.

Despite some limitations, OKX remains a strong contender among global cryptocurrency exchanges. To make an informed decision, traders should weigh these pros and cons based on their individual needs and trading preferences.

Conclusion

OKX is a leading cryptocurrency exchange with diverse trading options, high liquidity, and competitive fees. Its advanced features, including futures, margin trading, and staking, cater to all types of traders. While regulatory uncertainties and limited fiat support may be drawbacks, OKX remains a reliable platform for crypto trading and investment. Users should assess their needs and understand the platform before trading.