Retained earnings represent the portion of a company’s net income that is kept within the business rather than distributed as dividends to shareholders. This figure reflects the accumulated profits that are reinvested to fund operations, pay down debt, or support future growth.

Continue reading this article on TOPCOIN9 to understand the meaning, calculation formula for retained earnings, and learn why this concept is crucial in evaluating a company’s financial health and long-term strategy.

What Are Retained Earnings?

Retained earnings represent the cumulative net profits a company keeps after paying dividends to shareholders. These earnings are not distributed but are instead reinvested in the business to support growth, expansion, or debt repayment (Investopedia, 2025). Retained earnings are a key indicator of a company’s financial health, showing how much profit has been set aside over time to fuel future operations or investments (Stripe, 2025).

According to Oklahoma State University Extension, retained earnings accumulate from net income over the life of the business, minus any withdrawals or distributions (Oklahoma State University, 2021). This figure is updated at the end of each accounting period and can be positive or negative, depending on the company’s profitability and dividend policy.

Retained earnings are reported in the shareholders’ equity section of the balance sheet and serve as a reserve that management can use for reinvestment, business expansion, or strengthening the company’s financial position (Investopedia, 2025).

Now that you know what retained earnings are, let’s look at the formula used to calculate them.

Retained Earnings Formula

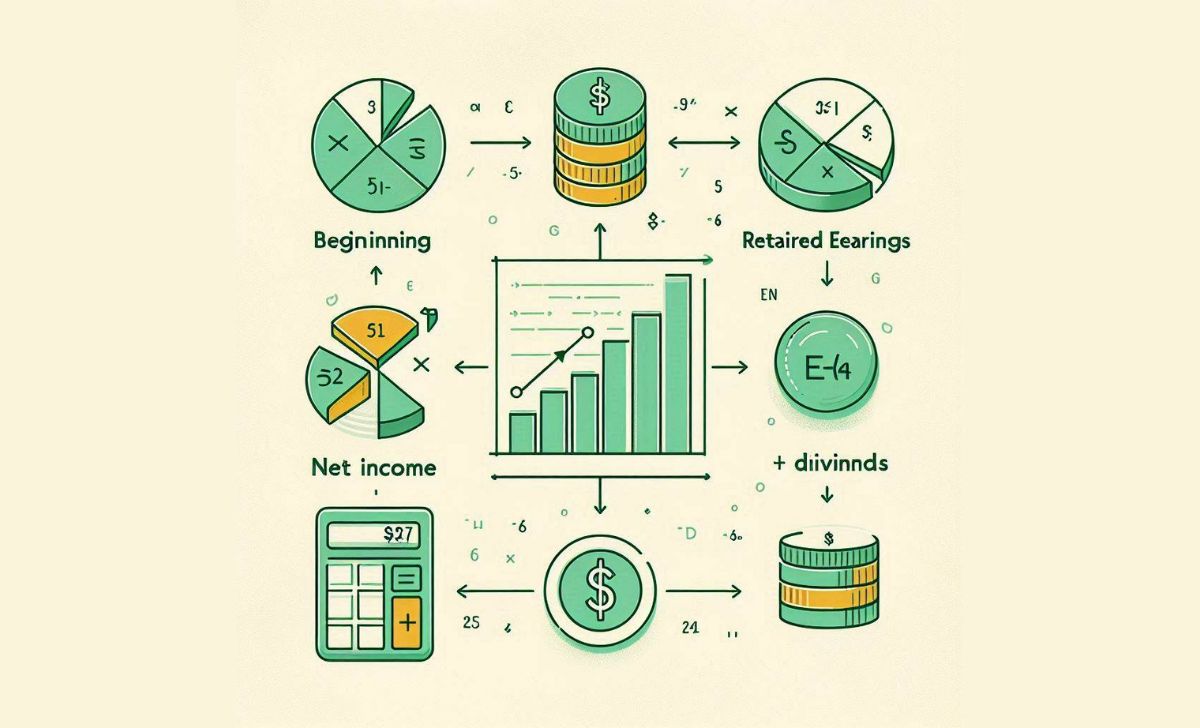

The retained earnings formula calculates the total profits a company keeps after paying out dividends to shareholders. The standard formula is:

Retained Earnings = Beginning Retained Earnings + Net Income (or Loss) – Dividends Paid

- Beginning Retained Earnings: The accumulated retained earnings from the previous accounting period, found in the equity section of the balance sheet (Investopedia, 2025).

- Net Income (or Loss): The profit or loss earned during the current period, as reported on the income statement (Wikipedia, 2024).

- Dividends Paid: The total dividends distributed to shareholders during the period, which are subtracted because they reduce the amount retained by the company (Harvard Business School Online, 2022).

Example:

If a company starts the year with $800,000 in retained earnings, earns $300,000 in net income, and pays $100,000 in dividends, the calculation is:

$800,000 + $300,000 – $100,000 = $1,000,000 in retained earnings at year-end (Harvard Business School Online, 2022).

This formula is essential for tracking how much profit a business has reinvested or kept in reserve over time, supporting growth, debt repayment, or future investments. Retained earnings are reported in the equity section of the balance sheet and provide a direct link between the income statement and balance sheet, reflecting the company’s long-term financial health (Wikipedia, 2024; Harvard Business School Online, 2022).

In the context of blockchain, these calculations and transactions can be recorded immutably, enhancing transparency and auditability.

With the formula in mind, we can explore how retained earnings are applied in business and why they are important.

Applications and Importance of Retained Earnings

Retained earnings play a vital role in a company’s financial health, growth, and long-term strategy. According to Yeshiva University (2022), retained earnings are the portion of net income not distributed as dividends but kept in reserve to fund business expansion, acquire assets, or support various ventures. In a free enterprise system, such reinvestment decisions are essential for maintaining competitiveness and adapting to market changes.

Key applications and importance include:

- Business Growth and Expansion: Companies use retained earnings to reinvest in new projects, purchase equipment, expand operations, or enter new markets, reducing reliance on external financing (YourLegal, 2024).

- Financial Stability: A strong retained earnings balance provides a financial cushion, enabling firms to weather economic downturns or unexpected expenses without excessive borrowing (YourLegal, 2024).

- Debt Repayment: Retained earnings can be allocated to pay down existing loans, lowering interest costs and improving overall financial health (IIFL Finance, 2024).

- Shareholder Value: Investors view healthy retained earnings as a sign of a company’s ability to generate long-term value, fund growth, and maintain stable dividend payments (YourLegal, 2024).

- Reporting and Analysis: Retained earnings are reported in the shareholders’ equity section of the balance sheet and may also appear in a separate statement of retained earnings, helping investors and management track profitability and reinvestment over time (IIFL Finance, 2024).

In summary, retained earnings reflect a company’s capacity for self-funded growth, financial resilience, and responsible profit management making them a crucial metric for business owners, investors, and analysts alike.

While retained earnings offer many advantages, it’s also important to consider their limitations and potential challenges.

Constraints and Factors to Consider

While retained earnings are a crucial indicator of financial health, there are important limitations and considerations for both businesses and analysts.

- Potential for Inequality and Misallocation: In market-driven systems, the focus on profit and retained earnings can lead to income inequality and the misallocation of resources, as firms may prioritize profit retention over employee welfare or environmental protection (Boston University, 2021).

- Unrealistic Model Assumptions: Many financial models assume perfect information, rational decision-making, and constant economic conditions. In reality, managers face incomplete information, uncertainty, and cognitive limitations, which can impact the effectiveness of retained earnings strategies (Gettysburg College, 2023).

- Over-Accumulation Risks: Excessive accumulation of retained earnings without effective reinvestment can signal missed growth opportunities or inefficient capital management, potentially reducing shareholder value (Investopedia, 2025).

- External Influences: Economic downturns, regulatory changes, and shifts in dividend policy can all affect retained earnings, sometimes requiring companies to use reserves to cover losses or support operations (Investopedia, 2025).

- Ethical and Social Considerations: Firms focusing solely on maximizing retained earnings may neglect broader social responsibilities, such as fair labor practices or environmental stewardship, leading to negative externalities (Boston University, 2021).

In conclusion, retained earnings are not only a key indicator of a company’s financial health but also a foundation for sustainable business growth. Understanding their meaning, formula, and practical applications empowers managers and investors to make informed decisions, optimize resources, and enhance long-term value.

For more in-depth financial knowledge, keep following TOPCOIN9 your trusted source for modern investors.

As a certified blockchain security expert with over 8 years in cybersecurity, James Anderson specializes in auditing smart contracts and identifying vulnerabilities in DeFi protocols. His expertise ensures that TopCoin9 delivers reliable insights on blockchain security and risk management.

Email: [email protected]