Token swap is the process of directly exchanging one token for another without intermediaries, commonly performed on decentralized exchanges (DEX) like Uniswap, PancakeSwap, and SushiSwap. Token swap stands out with fast transactions, low fees, multi-blockchain support, automatic liquidity through AMM (Automated Market Maker), and allows users to maintain full control of their assets in personal wallets.

There are various token swap methods including: DEX swap (Uniswap, 1inch), cross-chain bridges (for swapping between different blockchains), CEX trading, and atomic swaps. To ensure safety when swapping, you should carefully verify token contract addresses, use appropriate slippage, choose reputable DEXs, secure your Web3 wallet, and always verify information before trading. See more detailed guides and security tips from TOPCOIN9 below to swap tokens effectively and safely!

What Is a Token Swap?

A token swap is the exchange of one type of cryptocurrency token for another, which can occur through various mechanisms and serves different purposes in the blockchain ecosystem (Duke University, 2025). Token swaps are fundamental to decentralized finance (DeFi) operations, enabling users to trade assets in an atomic and noncustodial manner (Duke University, 2025).

There are two primary types of token swaps:

- Migration swaps: These involve updating a token by exchanging it to a new blockchain technology, where the technically outdated token is deleted after successful completion while maintaining the same token quantity for users (Wikipedia, 2019). Notable examples include EOS, Binance Coin, and Tron, which have all completed token swaps to migrate to new blockchain infrastructures (Wikipedia, 2019).

- Trading swaps: These facilitate the direct exchange of different tokens through decentralized exchanges (DEXs), where the swap only executes when exchange conditions are agreed to and met by all parties, enforced by smart contracts (Duke University, 2025).

Token swaps can be executed through two primary mechanisms on DEXs: order-book matching systems where market makers post bids and asks, or Automated Market Makers (AMMs) that use algorithmic pricing (Duke University, 2025). The key benefit of swapping in DeFi is that transactions are atomic and noncustodial, meaning funds are never held by intermediaries and trades either complete entirely or fail completely (Duke University, 2025).

Many traders monitor ethereum price closely before executing token swaps, as ETH often serves as a base trading pair and its price movements can significantly impact swap rates and gas fees across the Ethereum network.

Token swaps have become essential infrastructure for the cryptocurrency ecosystem, enabling seamless asset migration, cross-chain interoperability, and efficient trading without traditional intermediaries (Wikipedia, 2019; Duke University, 2025).

With a solid foundation of what token swapping is and its importance in the DeFi ecosystem, let’s explore the key features that make token swapping an essential tool for cryptocurrency users.

Key Features of Token Swapping

Token swapping platforms provide essential features that enable seamless cryptocurrency exchanges while maintaining security and efficiency (Duke University, 2025; Florida Institute of Technology, 2023). The key benefit of swapping in DeFi is that it is atomic and noncustodial, meaning funds are never held by intermediaries and trades either complete entirely or fail completely (Duke University, 2025).

Core features include:

- Atomic Execution: The swap only executes when exchange conditions are agreed to and met by all parties, enforced by smart contracts. If any condition is not met, the entire transaction is cancelled (Duke University, 2025).

- Noncustodial Trading: Users maintain control of their funds throughout the entire swap process, eliminating counterparty risk associated with centralized exchanges (Duke University, 2025).

- Smart Contract Automation: Decentralized swapping services facilitate the execution of token swaps using smart contracts without requiring intermediaries (Florida Institute of Technology, 2023).

- Cross-Chain Compatibility: Advanced swapping platforms support exchanges between tokens on different blockchains, enabling interoperability across various networks (Florida Institute of Technology, 2023).

- Multiple Liquidity Mechanisms: Token swaps can be executed through order-book matching systems where market makers post bids and asks, or through Automated Market Makers (AMMs) that use algorithmic pricing (Duke University, 2025).

- Real-Time Price Discovery: Market makers can update exchange rates as market conditions change, ensuring competitive pricing for token swaps (Duke University, 2025).

These features make token swapping a fundamental component of decentralized finance, enabling users to trade assets efficiently while maintaining full control over their funds (Duke University, 2025; Florida Institute of Technology, 2023).

After understanding the main features that define token swapping platforms, it’s important to examine the various methods available for conducting token swaps safely and efficiently.

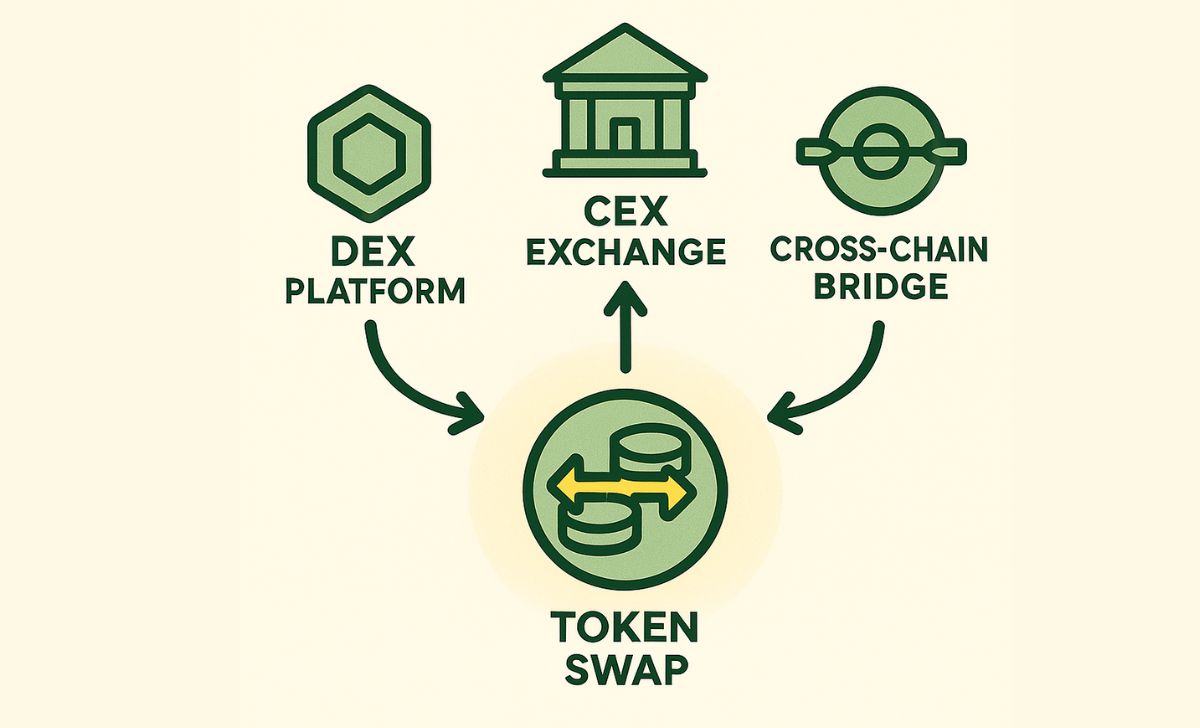

Methods of Token Swapping

Token swapping can be executed through several distinct methods, each designed to facilitate different types of cryptocurrency exchanges (Duke University, 2025; Cointelegraph, 2024). These methods range from simple same-chain exchanges to complex cross-blockchain transactions, each serving specific use cases in the decentralized finance ecosystem (Magic Eden, 2025).

Primary swapping methods include:

- On-Chain Swaps: Direct token exchanges within the same blockchain network, such as swapping one ERC-20 token for another on Ethereum, where tokens remain within the same ecosystem throughout the transaction (Magic Eden, 2025).

- Cross-Chain Swaps: Enable exchanges between tokens on different blockchains without using centralized exchanges, utilizing smart contracts to directly execute the exchange across separate blockchain networks (Magic Eden, 2025; Cointelegraph, 2024).

- Order-Book Matching: A system where market makers post bids and asks to decentralized exchanges, allowing takers to fill quotes at pre-agreed prices, though this approach can be expensive due to on-chain transaction requirements (Duke University, 2025).

- Automated Market Makers (AMMs): Algorithmic systems that use liquidity pools to facilitate swaps, where smart contracts lock tokens, verify transaction details, and execute trades by pulling matching tokens from liquidity pools (Duke University, 2025; Magic Eden, 2025).

- Bridging: Replaces tokens with their equivalent on another blockchain, such as converting SOL on Base to Solana blockchain or swapping BTC for wrapped WBTC (Magic Eden, 2025).

- Liquidity Pool Swaps: Users provide liquidity to DeFi protocols by swapping tokens for pool shares, receiving fees in return for their participation (Cointelegraph, 2024).

Each method serves specific purposes, from simple trading to complex DeFi protocol interactions, with smart contracts ensuring atomic execution where trades either complete entirely or fail completely (Duke University, 2025; Magic Eden, 2025).

Having covered the different approaches to token swapping, the final step is to review crucial safety tips that can protect your assets during the swapping process.

Safety Tips for Token Swapping

Token swapping requires careful attention to security practices to protect your digital assets from fraud, theft, and unauthorized access (MetaMask, 2025; UPay, 2024). The decentralized nature of token swaps means users bear full responsibility for transaction security, making proper precautions essential (MetaMask, 2025).

Essential safety practices include:

- Verify Token Addresses: Always double-check token contract addresses before swapping, as anyone can mint tokens with identical names to popular cryptocurrencies. Use official sources to confirm legitimate token addresses (MetaMask, 2025).

- Research Projects Thoroughly: Conduct due diligence on token projects, checking their longevity, community engagement, and legitimacy. Be wary of tokens that appear suddenly with dramatic price increases, as these may be rugpull schemes (MetaMask, 2025; FasterCapital, 2000).

- Use Reputable Platforms: Choose well-established swapping platforms with strong security track records, user reviews, and regulatory compliance. Opt for platforms that prioritize user security and employ robust protective measures (UPay, 2024; SDLC Corp, 2025). When researching DEX platforms for token swaps, many users ask “is dexscreener safe” for tracking and analyzing token data. DexScreener is generally considered safe as a read-only analytics tool that doesn’t require wallet connections, but always verify information independently before making swap decisions.

- Implement Hardware Security: Utilize hardware wallets like Ledger or Trezor to store cryptocurrencies offline, keeping private keys away from potential hackers. Consider cold storage options such as encrypted USB drives for additional protection (UPay, 2024).

- Enable Two-Factor Authentication: Activate 2FA on all swapping platform accounts using authentication apps like Google Authenticator rather than SMS-based methods, which are vulnerable to SIM swapping attacks (UPay, 2024; SDLC Corp, 2025).

- Verify Transaction Details: Always double-check recipient addresses, swap amounts, and transaction fees before confirming. Wait for multiple blockchain confirmations to ensure transaction finality and reduce reversal risks (UPay, 2024; Unstoppable Domains, 2025).

- Monitor Network Fees: Use fee-tracking tools to time swaps during periods of lower network congestion, especially on Ethereum where gas fees can spike significantly during peak usage (SDLC Corp, 2025).

Remember that token swaps are irreversible blockchain transactions, so taking time to verify all details before execution is crucial for protecting your investments (MetaMask, 2025; UPay, 2024).

Token swapping offers secure, decentralized trading through atomic execution and multiple exchange methods. Users must prioritize safety by verifying token addresses, using reputable platforms, and implementing proper security measures. For expert insights on DeFi trading and token swap strategies, visit TOPCOIN9 for the latest cryptocurrency guidance.

Sophia Mitchell is a passionate crypto educator with 6+ years of experience in blockchain training and community building. She has led educational initiatives for major crypto platforms and now empowers the TopCoin9 audience with valuable insights into Web3, staking, and DeFi.

Email: [email protected]